Liquidity Lifelines: How to Stay Afloat in Financial Storms

Liquidity: The Lifeblood of Financial Health

Liquidity, a fundamental concept in finance, refers to the ease with which an asset or security can be converted into cash without significantly impacting its market price. It’s akin to the lifeblood of financial systems, ensuring smooth operations and mitigating risks.

Types of Liquidity

Market Liquidity:

Definition:

Market liquidity measures how easily an asset can be bought or sold in the market without significantly affecting its price.

Factors Affecting Market Liquidity:

Market Depth

a. The number of buyers and sellers in the market.

b. A deeper market with more participants can absorb large trades without significant price impact.

Market Breadth

a. The range of bid and ask prices.

b. A wider spread indicates lower liquidity.

Trading Volume

a. The frequency of trades in a particular asset.

b. Higher trading volume generally implies better liquidity.

Examples of Highly Liquid Assets

- Publicly traded stocks

- Government bonds

- Commodities like gold and silver

Examples of Highly Liquid Assets:

Publicly traded stocks

Government bonds

Commodities like gold and silver

Importance:

Market liquidity is crucial for investors as it allows them to quickly enter and exit positions, reducing the risk of being locked into illiquid investments.

Accounting Liquidity:

Definition:

Accounting liquidity measures a company’s ability to meet its short-term obligations. It’s assessed by analyzing a company’s current assets and current liabilities.

Key Ratios:

Current Ratio:

i. This ratio compares current assets to current liabilities.

ii. A higher ratio indicates better liquidity.

Quick Ratio:

i. This ratio excludes inventory from current assets, providing a more conservative measure of liquidity.

Importance:

Adequate accounting liquidity is essential for businesses to: i. Pay suppliers and employees on time

ii. Meet short-term debt obligations

iii. Seize unexpected opportunities

iv. Weather economic downturns

Why Liquidity Matters

Liquidity is a critical factor for individuals, businesses, and economies. Here’s why:

- Risk Management: Liquid assets can be readily converted into cash to cover unexpected expenses, reducing financial risk.

- Market Stability: A liquid market is more stable as it can absorb large buy or sell orders without significant price fluctuations.

- Investor Confidence: High liquidity attracts investors as they know they can easily buy or sell assets without significant price impact.

- Business Operations: Sufficient liquidity ensures that businesses can meet their day-to-day operational needs, pay suppliers, and invest in growth.

- Economic Growth: A liquid financial system facilitates capital allocation, stimulating economic growth and development.

Understanding Liquidity Ratios: A Deeper Dive

Liquidity ratios are crucial financial metrics that offer insights into a company’s ability to meet its short-term obligations. These ratios are particularly important for assessing a company’s financial health, especially during periods of economic uncertainty.

Key Liquidity Ratios

Liquidity ratios are financial metrics used to assess a company’s ability to meet its short-term obligations using its most liquid assets. The two primary liquidity ratios are:

Current Ratio

Formula:

Current Ratio = Current Assets / Current Liabilities

Interpretation:

i. A higher current ratio indicates a stronger ability to meet short-term obligations.

ii. A ratio below 1 suggests potential liquidity issues, as the company may struggle to pay its bills.

iii. However, an excessively high current ratio may indicate inefficient use of assets.

Quick Ratio (Acid-Test Ratio)

Formula:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Interpretation:

i. The quick ratio is a more stringent measure of liquidity, as it excludes inventory.

ii. A higher quick ratio suggests a stronger ability to meet short-term obligations, even without liquidating inventory.

iii. A ratio below 1 may indicate potential liquidity problems, especially for businesses with high inventory levels.

Cash Ratio

Formula:

Cash Ratio = Cash and Cash Equivalents / Current Liabilities

Interpretation:

i. The cash ratio provides the most conservative measure of liquidity, focusing solely on the most liquid assets.

ii. A higher cash ratio indicates a very strong ability to meet immediate obligations.

iii. However, a very high cash ratio may suggest that the company is not utilizing its resources efficiently.

Factors Affecting Liquidity Ratios

Several factors can influence a company’s liquidity ratios:

- Industry-Specific Factors: Different industries have varying levels of liquidity needs. For example, retail businesses typically have higher inventory levels and may require higher liquidity ratios.

- Business Cycle: Economic cycles can impact a company’s liquidity. During economic downturns, sales may decline, leading to lower cash inflows and potentially weaker liquidity ratios.

- Financial Policies: A company’s financial policies, such as dividend payout ratios and capital expenditure plans, can affect its liquidity.

- External Factors: Events like natural disasters, geopolitical tensions, and changes in interest rates can impact a company’s liquidity.

Interpreting Liquidity Ratios

When interpreting liquidity ratios, it’s essential to consider the following:

- Benchmarking: Compare a company’s liquidity ratios to industry averages and historical trends.

- Trend Analysis: Analyze the trend of liquidity ratios over time to identify potential issues.

- Qualitative Factors: Consider qualitative factors such as the company’s management team, customer base, and competitive position.

Liquidity in Different Types of Assets: A Deeper Dive

Liquidity, as discussed, refers to the ease with which an asset can be converted into cash without significantly impacting its market price. Different asset classes exhibit varying degrees of liquidity, which can significantly impact an investor’s financial flexibility and risk profile.

Liquid vs. Illiquid Assets

Liquid Assets

Cash and Cash Equivalents:

a. These are the most liquid assets, as they can be immediately converted into cash.

b. Examples include currency, checking accounts, savings accounts, and money market funds.

c. These assets are ideal for meeting short-term obligations and emergencies.

Publicly Traded Stocks and Bonds:

a. These securities are highly liquid, especially for large, well-known companies.

b. They can be bought and sold on stock exchanges, providing relatively quick access to cash.

c. However, market volatility can impact the liquidity of these assets.

Mutual Funds:

a. Many mutual funds are highly liquid, allowing investors to buy and sell shares daily.

b. However, the underlying holdings of a mutual fund can impact its liquidity.

c. For example, a mutual fund investing in illiquid assets like private equity or real estate may have lower liquidity.

Illiquid Assets

Real Estate:

a. Real estate can be illiquid, especially commercial properties.

b. Selling real estate often involves significant transaction costs, including brokerage fees, legal fees, and property taxes.

c. Additionally, market conditions can impact the speed and price at which real estate can be sold.

Private Equity and Venture Capital:

a. These investments are highly illiquid, as they often involve long-term commitments and limited liquidity options.

b. Investors in these assets may have to wait several years before realizing any returns, and there may be restrictions on selling their shares.

Collectibles and Art:

a. These assets can be highly illiquid, as their value can be subjective and their market can be limited.

b. Selling collectibles and art often requires specialized knowledge and access to specific markets.

Levels of Liquidity in Common Assets

Stocks:

a. Large-cap stocks: These are typically highly liquid, as they are traded on major exchanges and have a large number of buyers and sellers.

b. Small-cap stocks: These may be less liquid, especially those with lower trading volumes and smaller market capitalizations.

c. Penny stocks: These are extremely illiquid and can be subject to significant price volatility.

Bonds:

a. Government bonds: These are generally highly liquid, especially those issued by developed countries.

b. Corporate bonds: The liquidity of corporate bonds can vary based on the issuer’s credit rating and the bond’s maturity. Investment-grade bonds are generally more liquid than high-yield bonds.

c. Municipal bonds: The liquidity of municipal bonds can vary depending on the issuer and the bond’s specific terms.

Real Estate:

a. Residential real estate: Single-family homes and condos in active markets can be relatively liquid. However, selling a home can take time and involve significant transaction costs.

b. Commercial real estate: Commercial properties, such as office buildings, retail centers, and industrial warehouses, can be less liquid. Large commercial properties may require significant time and effort to sell.

How Asset Liquidity Impacts Financial Flexibility

Asset liquidity significantly impacts an individual’s or a company’s financial flexibility.

- Access to Cash: Liquid assets provide immediate access to cash, enabling individuals and businesses to meet financial obligations, seize investment opportunities, or weather economic downturns.

- Risk Management: A diversified portfolio with a mix of liquid and illiquid assets can help manage risk. Liquid assets can be used to cover unexpected expenses or to rebalance the portfolio.

- Investment Horizons: The liquidity of assets can influence investment horizons. Long-term investors may be more comfortable with illiquid assets, while short-term investors may prefer liquid assets.

- Diversification: A diversified portfolio with assets of varying liquidity can help reduce overall portfolio risk.

Liquidity in Personal Finance: A Deeper Dive

Liquidity in personal finance refers to the ease with which an individual can access their assets to meet financial obligations. It is a crucial aspect of financial planning, as it ensures financial security and flexibility.

Emergency Funds and Cash Reserves

An emergency fund is a crucial component of personal finance. It is a readily accessible pool of cash that can be used to cover unexpected expenses, such as medical bills, job loss, or car repairs. A well-stocked emergency fund can provide a sense of security and peace of mind.

Key Considerations for Building an Emergency Fund:

- Amount: Aim to save three to six months’ worth of living expenses. This amount can vary depending on individual circumstances, such as job stability, income levels, and family size.

- Accessibility: The funds should be easily accessible, such as in a high-yield savings account or a money market fund. Avoid investing in assets that may be difficult to liquidate quickly, such as stocks or real estate.

- Safety: The funds should be invested in low-risk, FDIC-insured institutions. This ensures that the funds are protected from loss, even in the event of a bank failure.

- Tax Efficiency: Consider using tax-advantaged accounts, such as a Health Savings Account (HSA) or a Flexible Spending Account (FSA), to build an emergency fund. These accounts offer tax benefits and can be used for qualified medical expenses.

Planning for Personal Financial Liquidity Needs

To maintain adequate liquidity, individuals should consider the following:

- Assess Financial Goals: Identify short-term and long-term financial goals, such as buying a home, retirement, or education. This will help you prioritize your savings and investment strategies.

- Create a Budget: A budget helps track income and expenses, allowing for better financial planning and savings. By understanding your spending habits, you can identify areas where you can cut back and increase your savings.

- Prioritize Savings: Allocate a portion of your income to savings and investments. This can be done through automatic deductions from your paycheck or by setting aside a portion of your income each month.

- Diversify Investments: A diversified investment portfolio with a mix of liquid and illiquid assets can help balance risk and return. Liquid assets, such as cash and cash equivalents, can be used to meet short-term needs, while illiquid assets, such as real estate or private equity, can provide long-term growth potential.

- Review Financial Situation Regularly: Periodically review your financial goals, budget, and investment portfolio to make necessary adjustments. This will help you stay on track and adapt to changing circumstances.

Balancing Liquid and Illiquid Investments in Portfolios

A well-balanced investment portfolio includes a mix of liquid and illiquid assets. The optimal mix depends on individual circumstances, risk tolerance, and financial goals.

Liquid Investments:

- Cash and Cash Equivalents: These provide immediate liquidity but offer low returns. They are ideal for emergency funds and short-term savings goals.

- Stocks and Bonds: These can be highly liquid, especially for publicly traded securities. However, market volatility can impact their liquidity. A diversified portfolio of stocks and bonds can provide a balance of risk and return.

- Mutual Funds: Many mutual funds are highly liquid, allowing investors to buy and sell shares daily. However, the underlying holdings of a mutual fund can impact its liquidity. For example, a mutual fund investing in illiquid assets like private equity or real estate may have lower liquidity.

Illiquid Investments:

- Real Estate: Real estate can be illiquid, especially commercial properties. Selling real estate often takes time and involves significant transaction costs. However, real estate can be a valuable long-term investment, providing both income and appreciation.

- Private Equity and Venture Capital: These investments are highly illiquid, as they often involve long-term commitments and limited liquidity options. However, they can offer high potential returns.

- Collectibles and Art: These assets can be highly illiquid, as their value can be subjective and their market can be limited.

Liquidity in Business Finance: A Deeper Dive

Liquidity in business finance is the ability of a company to meet its short-term obligations. It is a critical factor in ensuring the financial health and stability of a business. A company with strong liquidity can weather economic downturns, seize opportunities, and maintain investor confidence.

Importance of Cash Flow Management for Business Liquidity

Cash flow management is the process of monitoring and managing a company’s cash inflows and outflows. It is essential for maintaining adequate liquidity.

Key aspects of cash flow management:

- Cash Budgeting:

a. Creating a detailed cash budget helps to forecast future cash flows and identify potential shortfalls.

b. It involves estimating cash inflows from sales, investments, and financing activities, as well as cash outflows for operating expenses, capital expenditures, and debt repayments.

c. By analyzing cash flow projections, businesses can identify periods of potential cash shortages and take proactive measures to address them. - Accounts Receivable Management:

a. Efficiently collecting payments from customers can significantly improve cash flow.

b. Implementing strict credit policies, offering early payment discounts, and using automated billing and collection systems can help accelerate cash inflows.

c. Monitoring accounts receivable aging reports can help identify overdue payments and take timely action to collect them. - Inventory Management:

a. Effective inventory management helps to minimize excess inventory and improve cash flow.

b. By optimizing inventory levels, businesses can reduce storage costs, minimize the risk of obsolescence, and free up cash for other purposes.

c. Implementing inventory management techniques such as just-in-time inventory and demand forecasting can help improve inventory turnover and reduce working capital requirements. - Accounts Payable Management:

a. Optimizing payment terms with suppliers can help manage cash outflows.

b. By negotiating favorable payment terms, such as extended payment periods or discounts for early payment, businesses can improve their cash flow position.

c. Effective accounts payable management also involves timely processing of invoices and payments to avoid late fees and penalties.

Working Capital and Its Role in Liquidity

Working capital is the difference between a company’s current assets and current liabilities. It represents the funds available to finance a company’s day-to-day operations.

Key components of working capital:

Inventory:

a. The level of inventory held by a company can impact its liquidity. Excess inventory can tie up cash and reduce liquidity.

b. By implementing efficient inventory management techniques, businesses can optimize inventory levels and improve cash flow.

Accounts Receivable:

a. The efficiency of collecting payments from customers can affect a company’s cash flow.

b. By implementing strict credit policies, offering early payment discounts, and using automated billing and collection systems, businesses can accelerate cash inflows.

Accounts Payable:

a. The timing of payments to suppliers can impact a company’s cash flow.

b. By negotiating favorable payment terms, such as extended payment periods or discounts for early payment, businesses can improve their cash flow position.

Managing Assets and Liabilities to Ensure Operational Stability

To ensure operational stability, businesses need to manage their assets and liabilities effectively.

Key strategies:

1. Asset Management:

a. Efficiently managing inventory levels: By implementing inventory management techniques such as just-in-time inventory and demand forecasting, businesses can optimize inventory levels and reduce holding costs.

b. Optimizing the use of fixed assets: By regularly reviewing and maintaining fixed assets, businesses can maximize their lifespan and utilization.

c. Monitoring and managing accounts receivable: By implementing strict credit policies, offering early payment discounts, and using automated billing and collection systems, businesses can accelerate cash inflows.

2. Liability Management:

a. Negotiating favorable payment terms with suppliers: By negotiating extended payment periods or discounts for early payment, businesses can improve their cash flow position.

b. Managing debt levels to avoid excessive interest payments: By maintaining a healthy debt-to-equity ratio and prioritizing debt repayment, businesses can reduce their interest expense burden.

c. Optimizing the capital structure to balance debt and equity financing: By carefully considering the costs and benefits of different financing options, businesses can improve their financial flexibility and liquidity.

Factors Affecting Liquidity: A Deeper Dive

Liquidity, the ability to convert assets into cash quickly and efficiently, is influenced by various economic, financial, and market factors. Understanding these factors is crucial for individuals and businesses to make informed financial decisions.

Economic Conditions, Interest Rates, and Market Sentiment

1. Economic Conditions:

a. Recession: During recessions, economic activity slows down, and businesses may face liquidity challenges as sales decline and costs rise. This can lead to increased demand for liquidity and potential asset price declines.

b. Economic Boom: In periods of economic expansion, businesses may have increased access to credit and liquidity. However, rising interest rates can impact borrowing costs and reduce liquidity.

2. Interest Rates:

a. Rising Interest Rates: Higher interest rates can reduce borrowing capacity and increase the cost of debt, impacting a company’s liquidity. This can lead to reduced investment and lower demand for goods and services, affecting overall liquidity.

b. Falling Interest Rates: Lower interest rates can stimulate economic activity and increase borrowing and investment. This can improve liquidity conditions for businesses and individuals.

3. Market Sentiment:

a. Investor Confidence: Positive market sentiment can increase demand for assets, making them more liquid. Conversely, negative market sentiment can lead to decreased demand and lower liquidity.

b. Market Volatility: Increased market volatility can create uncertainty and reduce liquidity, as investors may be hesitant to buy or sell assets.

Business Cycle Impact on Asset Liquidity

The business cycle, which consists of periods of expansion and contraction, can significantly impact asset liquidity.

1. Expansion Phase:

a. Increased economic activity: During economic expansions, businesses tend to have higher levels of cash flow and profitability, which can improve their liquidity.

b. Rising asset prices: As the economy grows, asset prices, such as stocks, bonds, and real estate, may appreciate, making them easier to sell and convert into cash.

c. Increased investor confidence: Positive economic conditions can boost investor confidence, leading to increased demand for assets and higher liquidity.

2. Contraction Phase:

a. Decreased economic activity: During economic contractions, businesses may experience reduced sales, lower profits, and increased costs, which can strain their liquidity.

b. Falling asset prices: As the economy slows down, asset prices may decline, making it more difficult to sell assets and raise cash.

c. Decreased investor confidence: Negative economic conditions can lead to decreased investor confidence, reducing demand for assets and increasing market volatility.

How External Factors Influence Access to Liquid Assets

Several external factors can influence access to liquid assets:

Regulatory Environment:

a. Government regulations can impact the liquidity of certain assets. For example, stricter regulations on bank lending can reduce access to credit.

b. Changes in tax laws can also affect liquidity by altering the tax implications of investment decisions.

Geopolitical Events:

a. Geopolitical events, such as wars, political instability, or trade disputes, can create uncertainty and reduce investor confidence, leading to decreased liquidity.

b. These events can also disrupt supply chains, increase costs, and reduce economic activity, further impacting liquidity.

Natural Disasters:

a. Natural disasters, such as hurricanes, earthquakes, and floods, can cause significant economic damage and disrupt supply chains.

b. These events can lead to increased demand for liquidity as businesses and individuals seek to repair damages and rebuild.

Technological Advancements:

a. Technological advancements can impact liquidity by changing the way assets are traded and valued. For example, the rise of fintech has made it easier to trade stocks and bonds online, increasing liquidity.

Liquidity Management Strategies: A Deeper Dive

Liquidity management is a critical aspect of financial planning for individuals and businesses alike. It involves ensuring that sufficient funds are available to meet short-term obligations while also investing for long-term goals.

Tools for Improving Liquidity

📌 Lines of Credit

🔹 Types of Lines of Credit

- 📌 Revolving Lines of Credit: Flexible borrowing with access to funds up to a set limit.

- 📌 Term Lines of Credit: Fixed repayment periods for specific projects or investments.

🔹 Benefits of Lines of Credit

- ⚡ Quick Access to Funds: Fast access without lengthy approval processes.

- ⚡ Risk Management: Helps mitigate unexpected expenses and cash flow shortages.

💰 Cash Reserves

🔹 Importance of Cash Reserves

- 💡 Financial Safety Net: Provides security during financial emergencies.

- 💡 Investment Opportunities: Can be used to seize investment chances or pay off debt.

🔹 Strategies for Building Cash Reserves

- 💵 Budgeting: Track income and expenses to identify savings areas.

- 💵 Automate Savings: Set up automatic transfers to a savings account.

- 💵 High-Yield Savings Accounts: Earn higher interest on stored cash.

Reducing Liquidity Risk through Diversification

Diversification is a strategy that involves spreading investments across various asset classes to reduce risk. By diversifying, individuals and businesses can reduce their reliance on any single asset or investment strategy, which can help mitigate liquidity risk.

- Asset Allocation:

a. Allocate investments across different asset classes, such as stocks, bonds, and real estate.

b. Consider factors like risk tolerance, time horizon, and financial goals when determining the optimal asset allocation. - Geographic Diversification:

a. Invest in assets from different countries to reduce exposure to specific country risks.

b. This can help mitigate the impact of economic, political, and currency fluctuations. - Industry Diversification:

a. Invest in companies from different industries to reduce exposure to industry-specific risks.

b. This can help protect your portfolio during economic downturns or industry-specific challenges.

Strategies for Balancing Short-Term and Long-Term Needs

Balancing short-term and long-term financial needs requires careful planning and prioritization.

1. Short-Term Needs:

a. Emergency Fund: Maintain an adequate emergency fund to cover unexpected expenses.

b. High-Yield Savings Accounts: Use high-yield savings accounts for short-term savings goals.

c. Short-Term Investments: Consider short-term investments like certificates of deposit (CDs) for specific short-term goals.

2. Long-Term Needs:

a. Retirement Savings: Contribute to retirement accounts like 401(k)s and IRAs.

b. Investment Portfolio: Build a diversified investment portfolio with a mix of stocks, bonds, and other assets.

c. Regular Review: Regularly review your financial plan and adjust it as needed to align with your changing needs and goals.

Liquidity Risks and Challenges: A Deeper Dive

Liquidity risk refers to the risk of not being able to meet short-term financial obligations due to insufficient cash or liquid assets. It can arise from various factors and have significant consequences for individuals, businesses, and the overall economy.

Causes of Liquidity Risk

1. Economic Downturns:

a. Economic recessions can lead to decreased demand for products and services, reduced sales, and increased costs, which can strain liquidity.

b. Businesses may face challenges in collecting payments from customers, leading to delayed cash inflows.

c. Increased unemployment rates can reduce consumer spending, further impacting business revenues.

2. Market Volatility:

a. Fluctuations in market prices can impact the value of assets, making it difficult to sell them quickly at fair market value.

b. During periods of high market volatility, investors may become more risk-averse, reducing demand for assets and increasing liquidity risk.

3. Unexpected Expenses:

a. Unforeseen expenses, such as natural disasters, legal disputes, or equipment failures, can drain cash reserves and create liquidity challenges.

b. These unexpected costs can disrupt cash flow and make it difficult to meet short-term obligations.

4. Poor Financial Management:

a. Ineffective cash flow management, excessive debt, and overinvestment can lead to liquidity problems.

b. Poor financial planning and decision-making can result in cash shortages and difficulty meeting obligations.

Types of Liquidity Risk

1. Funding Liquidity Risk:

a. This occurs when a company cannot access sufficient funds to meet its short-term obligations, even if it has valuable assets.

b. This can happen due to factors such as credit rating downgrades, market illiquidity, or a loss of investor confidence.

2. Market Liquidity Risk:

a. This arises when it is difficult to sell assets quickly at fair market value, especially during times of market stress.

b. This can occur during periods of market volatility, economic downturns, or when there is limited demand for specific assets.

Consequences of Poor Liquidity Management

1. Financial Distress:

a. Inadequate liquidity can lead to financial distress, including difficulty paying bills, defaulting on loans, and bankruptcy.

b. This can damage a company’s creditworthiness and make it harder to access financing in the future.

2. Loss of Opportunities:

a. A lack of liquidity can prevent businesses from taking advantage of growth opportunities, such as acquisitions, expansions, or research and development.

b. This can limit a company’s ability to compete and innovate.

3. Damaged Reputation:

a. Liquidity problems can damage a company’s reputation, making it harder to attract investors, customers, and talented employees.

b. Negative publicity can lead to decreased customer confidence and increased costs of capital.

4. Systemic Risk:

a. In severe cases, liquidity crises can spread throughout the financial system, leading to broader economic instability.

b. When multiple companies or financial institutions experience liquidity problems, it can create a chain reaction that can destabilize the entire economy.

Mitigating Liquidity Risks

1. Strong Financial Planning:

a. Develop a detailed financial plan that includes budgeting, cash flow forecasting, and risk assessment.

b. Regularly monitor financial performance and adjust plans as needed to address changing economic conditions.

2. Diversification:

a. Diversify investments across different asset classes and geographies to reduce exposure to specific risks.

b. This can help mitigate the impact of market volatility and economic downturns.

3. Emergency Fund:

a. Maintain an adequate emergency fund to cover unexpected expenses.

b. This can provide a safety net and reduce the need to liquidate assets during times of stress.

4. Effective Cash Management:

a. Implement strong cash management practices, such as optimizing accounts receivable and payable cycles.

b. Use cash flow forecasting to anticipate future cash needs and plan accordingly.

5. Risk Management:

a. Identify and assess potential liquidity risks, such as interest rate risk, currency risk, and credit risk.

b. Develop strategies to mitigate these risks, such as hedging or insurance.

6. Access to Credit:

a. Maintain good credit relationships with banks and other financial institutions.

b. Having access to credit can provide a safety net in case of liquidity shortages.

Liquidity in Investment and Trading: A Deeper Dive

Liquidity, the ability to buy or sell an asset quickly and easily at a fair price, is a critical factor in investment and trading. It directly impacts an investor’s ability to execute trades, manage risk, and generate returns.

Importance of Market Liquidity for Investors

1. Execution Costs:

a. High liquidity generally leads to lower transaction costs, as there are more buyers and sellers, reducing the bid-ask spread.

b. This means investors can buy and sell assets at prices closer to the fair market value, reducing the impact of transaction costs on their overall returns.

2. Market Impact Cost:

a. In illiquid markets, large trades can significantly impact the price of an asset. High liquidity reduces this impact.

b. When a large order is placed in an illiquid market, it can move the price significantly, leading to adverse price movements for the investor.

3. Risk Management:

a. Liquid assets can be easily sold to raise cash, allowing investors to manage risk and rebalance portfolios.

b. This is particularly important during market downturns or when unexpected expenses arise.

4. Investment Horizon:

a. Liquidity can influence an investor’s investment horizon. Highly liquid assets are suitable for short-term trading strategies, as they can be bought and sold quickly.

b. Less liquid assets, such as private equity or real estate, may be more appropriate for long-term investment horizons, as they may require a longer time horizon to realize their value.

High-Liquidity vs. Low-Liquidity Investments: Pros and Cons

💵 High-Liquidity Investments

📈 1. Pros

- ✔ Easy to Buy and Sell: Can be easily traded on exchanges or over-the-counter markets.

- ✔ Lower Transaction Costs: High liquidity leads to lower transaction costs.

- ✔ Lower Market Impact Cost: Large trades have a smaller impact on the asset price.

📉 2. Cons

- ❌ Potentially Lower Returns: Government bonds or blue-chip stocks may offer lower returns compared to illiquid assets.

💸 Low-Liquidity Investments

📈 1. Pros

- ✔ Potential for Higher Returns: Illiquid assets like private equity or real estate may offer higher returns.

- ✔ Less Competition: Fewer investors, reducing competition and potentially leading to better opportunities.

📉 2. Cons

- ❌ Difficulty in Buying and Selling: Harder to buy/sell due to limited buyers and sellers.

- ❌ Higher Transaction Costs: Transaction costs tend to be higher in illiquid markets.

- ❌ Significant Market Impact Cost: Large trades can significantly affect the asset price.

Role of Liquidity in Portfolio Management and Trading Decisions

Portfolio Management:

- Asset Allocation: Liquidity should be considered when allocating assets across different asset classes. A balanced portfolio may include a mix of liquid and illiquid assets to meet various financial goals.

- Risk Management: Liquidity can help manage risk by allowing investors to rebalance their portfolios and adjust their exposure to different asset classes. By having a portion of their portfolio in liquid assets, investors can quickly raise cash to meet unexpected expenses or to take advantage of new investment opportunities

Trading Decisions:

- Trading Strategy: Liquidity is a key factor in choosing trading strategies. High-frequency traders, for example, rely on highly liquid markets to execute a large number of trades quickly.

- Market Timing: Liquidity can impact the ability to time market entries and exits. In illiquid markets, it may be difficult to sell assets at the desired price, especially during periods of market stress.

Monitoring and Adjusting Liquidity Needs

Effective liquidity management is a continuous process that requires careful monitoring and adjustment. By regularly reviewing liquidity positions and adapting strategies to changing economic conditions, individuals and businesses can ensure financial stability and seize opportunities.

Periodic Review of Liquidity Position for Financial Health

1. Regular Assessment:

a. Financial Statements: Conduct regular reviews of cash flow statements, balance sheets, and income statements to assess the current liquidity position.

b. Key Metrics: Monitor key liquidity ratios such as the current ratio, quick ratio, and cash ratio to gauge the ability to meet short-term obligations.

c. Cash Flow Forecasting: Develop detailed cash flow forecasts to predict future cash inflows and outflows. Consider factors such as sales projections, expense budgets, and capital expenditure plans.

2. Cash Flow Forecasting:

a. Scenario Analysis: Conduct scenario analysis to assess the impact of different economic scenarios on cash flow. This helps identify potential risks and opportunities.

b. Sensitivity Analysis: Analyze the sensitivity of cash flow to changes in key variables such as sales, costs, and interest rates. This helps understand the potential impact of unexpected events.

Adjusting Liquidity Strategies for Economic Changes

1. Economic Expansion:

a. Increased Investment: During periods of economic expansion, businesses may have increased opportunities for growth and investment.

b. Reduced Liquidity Reserves: As cash flows improve, businesses may consider reducing excess liquidity reserves and investing in growth initiatives.

c. Diversification: Diversify investments across different asset classes to reduce risk and generate higher returns.

2. Economic Contraction:

a. Conserve Cash: During economic downturns, businesses may need to conserve cash and reduce expenses.

b. Cost Cutting: Implement cost-cutting measures, such as reducing labor costs, renegotiating contracts, and delaying non-essential investments.

c. Liquidity Reserves: Maintain sufficient liquidity reserves to weather economic storms and meet financial obligations.

3. Interest Rate Changes:

a. Rising Interest Rates: Rising interest rates can increase borrowing costs and reduce liquidity. Consider refinancing debt at lower interest rates, extending debt maturities, and maintaining sufficient cash reserves.

b. Falling Interest Rates: Falling interest rates can reduce borrowing costs and stimulate economic activity. This may be an opportune time to invest in growth opportunities and refinance debt at lower rates.

Tips for Ensuring Adequate Liquidity Over Time

1. Diversification:

a. Diversify investments across different asset classes, industries, and geographies to reduce exposure to specific risks.

b. This can help mitigate the impact of market volatility and economic downturns.

2. Risk Management:

a. Implement effective risk management strategies to identify and mitigate potential liquidity risks.

b. This may involve hedging techniques, insurance, and contingency planning.

3. Strong Financial Planning:

a. Develop a comprehensive financial plan that outlines short-term and long-term goals.

b. This helps in aligning liquidity management strategies with overall financial objectives.

4. Regular Review and Adjustment:

a. Continuously monitor and adjust liquidity strategies to adapt to changing circumstances.

b. Regularly review financial performance, market trends, and economic indicators to identify potential risks and opportunities.

5. Building Strong Relationships with Financial Institutions:

a. Maintain strong relationships with banks and other financial institutions to ensure access to credit and other financial services.

b. This can be crucial during times of financial stress.

6. Technology Adoption:

a. Utilize technology tools to improve cash flow forecasting, accounts receivable management, and inventory management.

b. This can help optimize cash flow and reduce the risk of liquidity shortages.

Conclusion: The Critical Role of Liquidity in Financial Stability and Growth

Liquidity is the lifeblood of financial health, acting as the cornerstone for individuals, businesses, and economies to function effectively. It ensures that assets can be quickly converted into cash without significantly impacting their value, providing the flexibility needed to meet short-term obligations, seize opportunities, and weather economic storms. Understanding and managing liquidity is not just a defensive strategy—it’s a proactive approach to building resilience, optimizing resources, and achieving long-term financial goals.

Key Insights:

Liquidity Ratios and Their Interpretation :

Liquidity ratios like the current ratio, quick ratio, and cash ratio provide insights into a company’s ability to handle short-term liabilities. Benchmarking these ratios against industry standards and analyzing trends over time helps identify potential risks and areas for improvement.

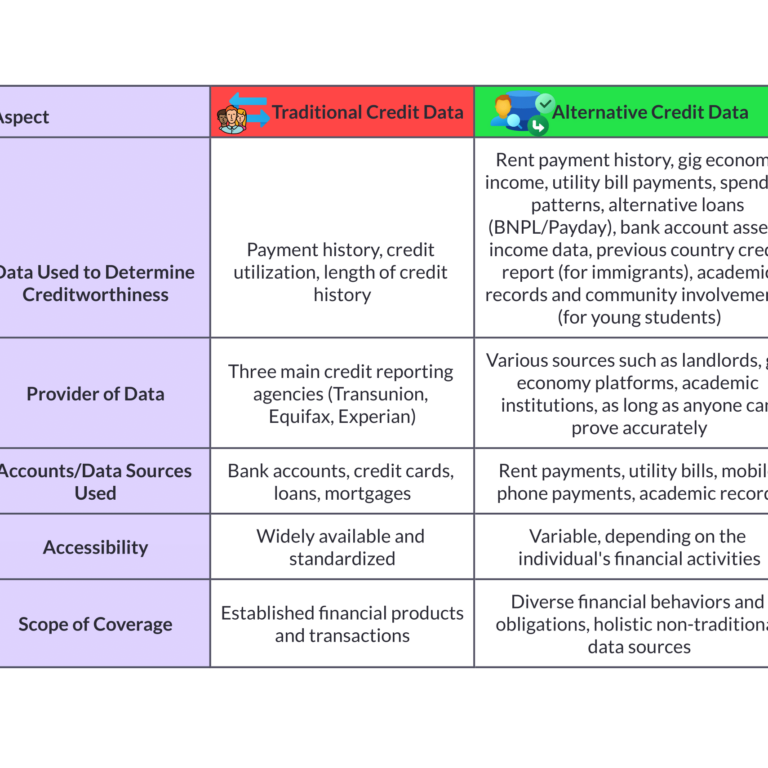

Asset Liquidity and Its Impact :

- Liquid Assets : Cash, publicly traded stocks, government bonds, and mutual funds offer immediate access to funds but may yield lower returns.

- Illiquid Assets : Real estate, private equity, and collectibles provide higher potential returns but come with longer holding periods and higher transaction costs.

- Balancing liquid and illiquid assets in a portfolio is key to managing risk and ensuring financial flexibility.

Liquidity in Personal Finance :

- Building an emergency fund, maintaining cash reserves, and diversifying investments are essential strategies for personal liquidity management.

- Regular budgeting, prioritizing savings, and reviewing financial goals help individuals stay prepared for both short-term needs and long-term aspirations.

Liquidity in Business Finance :

- Effective cash flow management, including cash budgeting, accounts receivable and payable management, and inventory optimization, is vital for maintaining operational stability.

- Working capital management ensures businesses have sufficient resources to meet day-to-day obligations while investing in growth.

Factors Affecting Liquidity :

- Economic conditions, interest rates, market sentiment, geopolitical events, and technological advancements all influence liquidity levels. Businesses and investors must remain vigilant to adapt to these external factors.

Liquidity Risks and Challenges :

- Poor liquidity management can lead to financial distress, missed opportunities, reputational damage, and even systemic risks during crises.

- Mitigating liquidity risks involves strong financial planning, diversification, maintaining emergency funds, and leveraging credit relationships.

Liquidity in Investment and Trading :

- Market liquidity impacts execution costs, market impact costs, and risk management. Investors must balance high-liquidity investments (e.g., blue-chip stocks) with low-liquidity ones (e.g., private equity) based on their risk tolerance and investment horizon.

- Portfolio managers should consider liquidity when allocating assets and making trading decisions to ensure flexibility and minimize costs.

Final Thoughts:

Liquidity is not merely a measure of financial health—it’s a dynamic tool that empowers individuals and businesses to navigate uncertainty and capitalize on opportunities. By understanding the nuances of liquidity, from asset classification to risk mitigation, stakeholders can make informed decisions that align with their short-term needs and long-term objectives.

To thrive in today’s fast-changing economic landscape, prioritize liquidity management as a core component of your financial strategy. Build robust cash reserves, diversify investments, monitor liquidity positions regularly, and leverage technology to optimize cash flow. Whether you’re safeguarding personal finances, steering a business through turbulent times, or crafting an investment portfolio, mastering liquidity will position you for sustained success and peace of mind.

In essence, liquidity is more than just having cash on hand—it’s about creating a foundation for financial agility, resilience, and growth. Start today by reviewing your liquidity position, adjusting your strategies, and preparing for whatever the future holds.