Financial Literacy Month: The Perfect Moment to Rewrite Your Financial Future

The world may have doubted you, but this April, it’s your turn to take the reins. Financial Literacy Month isn’t just a calendar event it’s your opportunity to learn the game, master the rules, and use them to take control of your money like never before.

Who exactly are “they,” you might wonder?

But here’s the truth: They were wrong. And this Financial Literacy Month, it’s time to prove it.

This Month, Take Control and Rewrite Your Financial Story

Ready to rewrite your financial story? This Financial Literacy Month, it’s time to stop letting outdated rules or misconceptions hold you back. Here’s how you can take control, step by step:

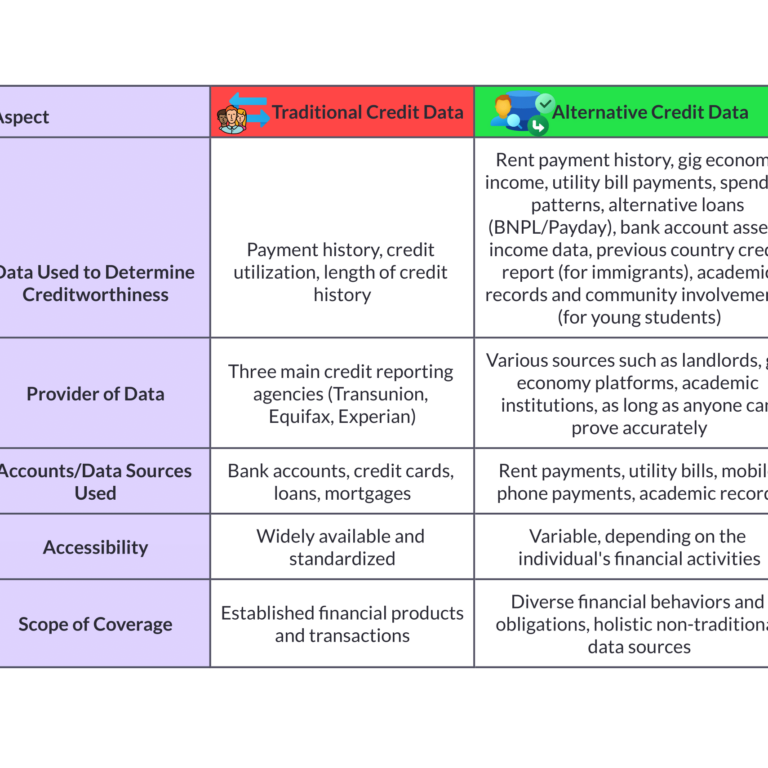

1. Build Credit Without Falling Into Debt

You’ve probably heard that credit cards and loans are the only ways to build your score. Spoiler alert: That’s not true. With tools like rent reporting services (e.g., AxcessRent) , you can turn your existing rent payments into a credit-building opportunity no new debt required. It’s a game-changer for anyone looking to boost their score while staying financially responsible.

2. Don’t Let Hidden Mistakes Drain Your Wallet

Did you know that 1 in 5 credit reports has errors? A simple mistake—like an account that doesn’t belong to you or an incorrect late payment entry—could be tanking your score. Don’t let someone else’s error cost you money. Grab your free credit report at AnnualCreditReport.com , review it carefully, and dispute anything that doesn’t add up. Fixing these mistakes could save you hundreds—or even thousands—in interest over time.

3. Pay Strategically, Not Stressfully

Debt can feel overwhelming, but there are proven strategies to tackle it head-on. Try the Avalanche Method (focus on high-interest debt first to save money) or the Snowball Method (pay off smaller balances for quick wins to stay motivated). And remember, on-time payments make up 35% of your credit score, so set up autopay wherever possible. Need extra help? Organizations like Operation HOPE offer free one-on-one coaching and workshops to guide you through debt repayment, budgeting, and more.

4. Save Like Your Future Depends On It (Because It Does)

Your emergency fund isn’t just a safety net—it’s your ultimate financial power move. Start small: aim for $500, then gradually build up to three to six months’ worth of expenses. Why? Because nothing screams “I’ve got this” like handling life’s curveballs without breaking a sweat. If you’re unsure where to find extra cash, tools like WorkMoney can help you uncover hidden savings in everyday expenses, from utility bills to groceries.

5. Stop Overpaying for Everything

Bad credit doesn’t just hurt your score it hits your wallet hard. Lower scores mean higher interest rates on loans, credit cards, and even car insurance. The better your credit, the less you’ll pay over time. So start taking control now. Enroll in credit-building courses, attend free workshops (like those offered by Operation HOPE ), and get expert advice to boost your score and keep more of your hard-earned money where it belongs—in your pocket.

From Rejection to Reinvention: Turning “No” Into Fuel for Growth

Rejection can sting, but let’s be real it’s rarely about you. More often than not, it’s a sign that you’re reaching for something bigger and better. A denied loan, credit card, or apartment application doesn’t mean the door is permanently closed; it simply means there’s room to grow, improve, and come back stronger than ever.

Instead of viewing rejection as a dead end, see it as a roadmap pointing you toward smarter decisions and long-term success. Every “no” is an opportunity to reassess, refine, and rise higher.

Turned down for a loan?

A rejection doesn’t mean you’re out of options it means it’s time to rebuild and strategize. Focus on strengthening your financial foundation: pay down existing debt, increase your income streams, and build an emergency fund to show lenders you’re a low-risk borrower. Once you’re in a stronger position, explore alternative lenders or peer-to-peer lending platforms that may offer more flexibility.

Can’t get approved for a credit card?

If traditional cards are out of reach, consider secured credit cards or becoming an authorized user on someone else’s account. These options can help you establish or rebuild credit over time. Use them responsibly by keeping balances low and paying on time, and soon you’ll qualify for better terms.

Struggling with high-interest rates?

High rates on loans or credit cards can feel like a never ending cycle. Take steps to improve your credit score so you can refinance at lower rates in the future. Tools like rent reporting, timely bill payments, and credit-builder loans can gradually boost your score, saving you thousands in interest over time.

Insurance premiums through the roof?

Believe it or not, your credit score often impacts your insurance rates. A low score could mean higher monthly payments for auto or home coverage. Take actionable steps to improve your credit—like clearing up errors, paying down revolving debt, and keeping old accounts open—and watch those premiums drop as your score climbs.

Dream job requires a background check but your credit is holding you back?

Many employers review credit reports as part of the hiring process. If your score is standing in the way, focus on cleaning up your report. Pay off collections accounts, automate payments to avoid missed deadlines, and monitor your progress regularly. Soon, you’ll be able to walk into any interview knowing your finances won’t hold you back.

Every challenge is an opportunity in disguise. By addressing these roadblocks head-on, you’re not just solving immediate problems you’re building long-term financial resilience. Progress may start small, but its impact will ripple far beyond what you imagined.

Prove Them Wrong. Your Comeback Story Starts Now—with AxcessRent.

Rejection doesn’t define you it refines you. Whether it’s a denied loan, a credit card application that didn’t go your way, or an apartment application that left you feeling defeated, these moments aren’t the end of the road. They’re the beginning of something greater: your comeback story.

And here’s the good news—you don’t have to do it alone. With tools like AxcessRent , you can turn everyday actions into powerful financial wins. From credit building to rent assistance , AxcessRent empowers you to take control of your financial future in ways that feel seamless and sustainable.

This Financial Literacy Month, let rejection be the catalyst for change. Start small, dream big, and let AxcessRent help pave the way to a stronger, more secure you.

Your future is waiting. Prove them wrong—and make it yours.