Financial Literacy for Life: How to Make Smarter Money Moves

Introduction to Financial Literacy Financial literacy is the foundation of a stable and prosperous life. It refers to the ability to understand and effectively use various financial skills, including personal financial management, budgeting, investing, and debt management. Without financial literacy, individuals may struggle with debt, poor savings habits, and inadequate retirement planning. Core Components of…

What Are Net Assets? A Comprehensive Guide to Financial Success

Net assets serve as one of the most critical indicators in financial reporting, providing a clear picture of an organization’s true financial position. This fundamental accounting concept applies universally across all sectors – from multinational corporations to small nonprofits and government agencies. By examining net asset, stakeholders can evaluate financial health, make informed decisions, and…

Can Previous Rent Payments Improve Your Credit Score? A Detailed Look

Introduction For many renters, monthly rent payments are their largest expense, yet they often go unreported on credit reports. That’s changing with retroactive rent reporting, a growing trend that allows you to add past rent payments to your credit history. But does previous rent actually boost your credit score? And how far back can you report it? In this guide, we’ll…

What Is Rent Reporting? Turn Your Rent Into Credit Success

Rent Reporting: The Credit Building Tool Renters Have Been Missing Every month, millions of responsible renters make their rent payments on time—often prioritizing this expense over others to keep up with their biggest financial obligation. It’s ironic, though, that while rent is typically someone’s largest monthly bill, these consistent payments usually don’t help build their…

Top Rental Investment Strategies for Passive Income and Long-Term Growth

Introduction: Why Rental Investment Is a Smart Wealth-Building Strategy ? Investing in rental properties is one of the most reliable ways to build long-term wealth. Unlike stocks or other volatile investments, real estate offers tangible benefits that can compound over time. The three pillars of rental investment—passive income , appreciation , and tax benefits —make…

Fixed Costs: Definition, Examples, and How to Manage Them Effectively

What Are Fixed Costs? A Complete Introduction Fixed costs represent the foundational, unchanging expenses that both individuals and businesses must pay regularly, irrespective of their income levels, production output, or spending patterns. These costs remain constant over a predetermined period—whether monthly, quarterly, or annually—providing financial predictability in budgeting. Unlike variable costs, which rise and fall…

Best Financial Advice: For Young Adults, Couples, Seniors & Inheritance Planning

Introduction In today’s uncertain economy, getting the right financial advice is more important than ever. With inflation, market volatility, and changing job landscapes, managing money wisely can mean the difference between financial security and constant stress. In 2025, economic uncertainty has become the new normal. Inflation continues to reshape purchasing power, job markets remain volatile,…

Economic Indicators 2025: Key Trends, Leading Indicators & How to Use Them

Introduction Economic indicators are vital tools that help analysts, investors, businesses, and policymakers gauge the health of an economy. By tracking these metrics, stakeholders can make informed decisions, anticipate market shifts, and adjust strategies accordingly. In 2025, understanding economic indicators is more crucial than ever due to evolving global markets, technological advancements, and geopolitical uncertainties. This guide…

Is a Debt Management Plan Right for You? (The Truth Revealed)

Debt can feel overwhelming, but with the right debt management strategies, you can take control of your finances and work toward a debt-free future. Whether you’re struggling with credit card debt, personal loans, or medical bills, understanding how to manage and repay debt effectively is crucial for long-term financial stability. In this guide, we’ll cover: By the…

Mastering Capital Budgeting: Your Blueprint for Long-Term Growth

Capital budgeting is a critical financial process that helps businesses evaluate long-term investments and allocate resources efficiently. Whether you’re a small business owner or a financial analyst at a large corporation, understanding capital budgeting is essential for making informed investment decisions. Capital budgeting, often referred to as investment appraisal, is the systematic process by which…

AB 2747 California: Empowering Landlords to Maximize Tenant Success

Introduction: The Game-Changing AB 2747 California Starting April 1, 2025 , California landlords with 15 or more residential rental units will be required to comply with AB 2747 , a groundbreaking law that mandates rent payment reporting to major credit bureaus. This legislation gives tenants an opportunity to build credit simply by paying rent on…

Smart Asset Allocation: 10 Easy Ways to Protect Your Money

Introduction: Why Asset Allocation Matters More Than Stock Picking Did you know that according to a landmark Vanguard study, over 90% of portfolio performance is determined by asset allocation rather than individual stock selection? This surprising fact underscores why understanding asset allocation is the single most important investing skill you can master. Key Questions We’ll Answer: We’ll…

Struggling to Understand Wills? Here’s Everything You Need to Know

Introduction to Wills: A Comprehensive Guide Planning for the future is one of the most responsible and thoughtful actions you can take, not just for yourself but also for your loved ones. At the heart of this planning lies a will , a legal document that ensures your wishes are carried out after your passing….

How Do Variable Interest Rates Work? A Simple Explanation for Borrowers

Introduction to Variable Interest Rates Variable interest rates are a type of interest rate that fluctuates over time, unlike fixed interest rates, which remain constant throughout the loan term. This variability is tied to a benchmark index, such as the prime rate or the federal funds rate. When the benchmark rate changes, the interest rate…

How Does Term Life Insurance Work? Key Facts You Need to Know

Introduction to Term Life Insurance What is Term Life Insurance How It Differs from Whole Life and Other Insurance Types: Why It’s a Popular Choice for Many Consumers: Term life insurance is widely preferred by consumers due to its affordability, simplicity, and flexibility. Unlike whole life insurance, which includes an investment component, term life insurance…

What Are the Best Tax Credits for Homeowners in 2025 ?

What are Tax Credits and How Do They Work? Tax credits are dollar-for-dollar reductions of your federal income tax liability. They directly lower the amount of tax you owe, making them more valuable than tax deductions, which only reduce your taxable income. To claim a tax credit, you typically need to meet specific eligibility requirements…

Tax Deductions You Should Know : Keep More, Pay Less

Why Pay More? Claim These Overlooked Tax Deductions! Introduction to Tax Deductions Tax deductions are expenses that you can subtract from your adjusted gross income (AGI) to reduce your taxable income, thereby lowering the amount of income subject to taxation. These deductions can include mortgage interest, medical expenses, student loan interest, charitable contributions, and business…

Financial Risk Management: Protecting Your Wealth & Investments

Is Financial Risk a Threat or an Opportunity? Financial risk refers to the uncertainty of potential financial loss. It is the possibility that an investment may not perform as expected or that unforeseen expenses may arise. While this uncertainty can lead to setbacks, ranging from minor disruptions to major financial crises, it also presents opportunities….

How Smart Refinancing Can Help You Achieve Financial Freedom Faster ?

Refinancing Made Simple: A Beginner’s Guide to Better Loan Terms Refinancing is the process of obtaining a new loan to pay off an existing one. This financial strategy can offer several benefits, particularly when interest rates decline or your financial situation improves. Common types of loans that can be refinanced include mortgages, auto loans, and…

The Power of Principal: How It Drives Wealth Creation Over Time

Understanding Principal: The Foundation of Every Loan and Investment Definition of Principal in Loan and Financial Terms In the realm of finance, principal refers to the initial sum of money involved in a financial transaction. It serves as the foundation for various financial operations, including loans, investments, and insurance. Importance of Principal in Debt and Investment The…

Net Worth Explained: How It Reflects Your Financial Success and Stability

Building a Strong Net Worth: Smart Financial Strategies Your net worth is a key measure of financial health, representing the difference between what you own (assets) and what you owe (liabilities). A positive net worth means you have more assets than debts, while a negative net worth indicates you owe more than you own. The…

What is Market Value? A Detailed Guide with Real-World Examples

Net Worth Explained: The Key to Financial Stability Definition of Market Value in Finance Market value, a fundamental concept in finance, represents the estimated price at which a financial asset or property would trade in a fair, open, and competitive market. It’s a dynamic figure that fluctuates based on various economic, industry, and company-specific factors….

Liquidity Lifelines: How to Stay Afloat in Financial Storms

Liquidity: The Lifeblood of Financial Health Liquidity, a fundamental concept in finance, refers to the ease with which an asset or security can be converted into cash without significantly impacting its market price. It’s akin to the lifeblood of financial systems, ensuring smooth operations and mitigating risks. Types of Liquidity Market Liquidity: Definition:Market liquidity measures…

Loan Amortization: How It Works and Why It’s Important

Understanding Loan Amortization: A Step-by-Step Breakdown Definition and Explanation of Amortization Amortization is a systematic process of repaying a debt over a specified period through regular installments. Each installment comprises two key components: The Amortization Schedule An amortization schedule is a detailed table that outlines each payment of a loan over time, breaking it down…

How Does Inflation Affect Your Savings, Investments, and Daily Life?

Inflation : Understanding the Rising Cost of Living Inflation, a term frequently encountered in economic discussions and news reports, refers to the general increase in the prices of goods and services over a specific period. It is a key indicator of an economy’s health, affecting everything from household expenses to business investments and government policies….

Mastering Financial Planning: Essential Tips for Managing Your Money Wisely

What is Financial Planning and Why is It Important?Financial planning is a comprehensive process that involves setting clear financial goals, creating a budget, managing debt, saving for emergencies, investing for the future, and planning for retirement. It serves as a roadmap that guides you toward financial security and long-term success. Effective financial planning also includes…

What is Estate Planning: Why You Shouldn’t Wait!

Introduction to Estate Planning What is Estate Planning? Estate planning is a proactive approach to organizing your financial affairs and ensuring a smooth transition of your assets to your loved ones. It involves creating a comprehensive plan that addresses various legal, financial, and personal considerations. This plan typically includes a will, trusts, powers of attorney,…

What Is Diversification and Why Is It Important for Your Investments?

Introduction to Diversification Is Diversification the Secret to Long-Term Wealth? Diversification is a fundamental investment strategy that involves spreading your investments across various assets to reduce risk. It’s like not putting all your eggs in one basket. By investing in different types of assets, you can minimize the impact of potential losses from any single…

Top Strategies to Improve Cash Flow: Simple Steps for Big Wins

Introduction to Cash-Flow What is Cash Flow? Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business. In simpler terms, it’s the money coming in (inflows) minus the money going out (outflows). Importance of Cash Flow in Personal Finances Understanding and managing your personal cash flow is…

From Bankruptcy to Financial Freedom: Your Roadmap to Success

Introduction to Bankruptcy Definition of Bankruptcy and Its Purpose Bankruptcy is a legal process that allows individuals and businesses to manage overwhelming debt by restructuring or eliminating it. It serves as a safety net for those who are unable to meet their financial obligations due to circumstances beyond their control, such as job loss, medical…

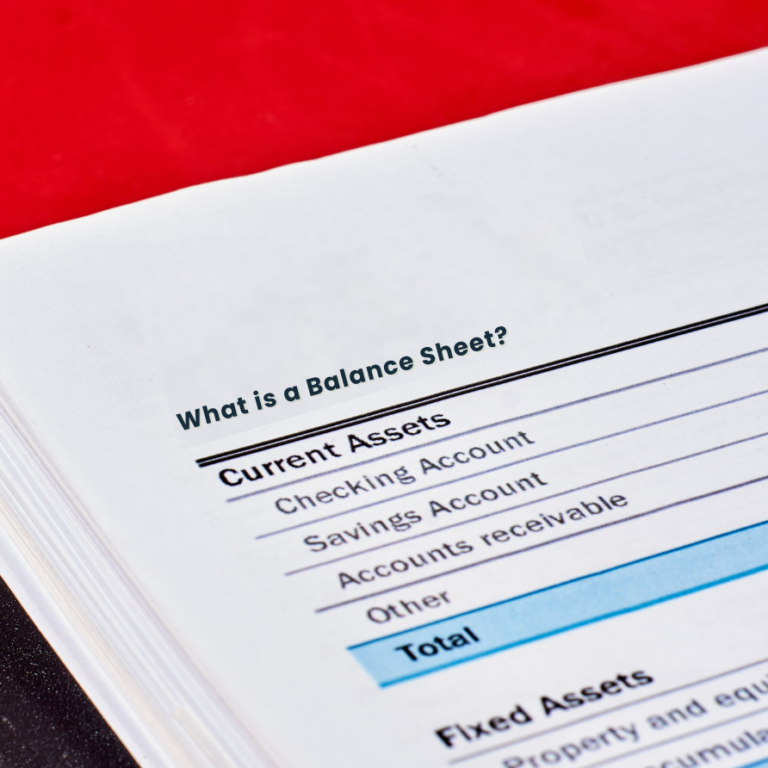

What is a Balance Sheet? A Simple Solution for Complex Financial Challenges

Introduction to the Balance Sheet A balance sheet, often referred to as the statement of financial position, is a financial statement that provides a snapshot of a company’s financial condition at a specific point in time. It presents a detailed overview of the company’s assets, liabilities, and equity. Definition and Purpose of a Balance Sheet Essentially, a balance…

Step-by-Step Guide to Mastering Asset Allocation for Beginners

Introduction to Asset Allocation Definition and Importance of Asset Allocation Asset allocation is the strategic process of dividing your investment portfolio among different asset classes to manage risk and achieve your financial goals. It involves determining the appropriate mix of investments, such as stocks, bonds, cash, and alternative assets. By diversifying your investments across various asset…

How Does Amortization Work? Key Concepts Explained

Introduction to Amortization What is Amortization ? Amortization is a financial process where a debt or loan is gradually paid off over time, typically with regular payments. These payments are divided into two parts: principal and interest. The principal portion reduces the outstanding loan balance, while the interest portion is the cost of borrowing the…

Top Tips for Qualifying for Financial Assistance Programs in 2025

Introduction Financial assistance programs are designed to provide individuals and families with the resources they need to meet basic needs such as housing, healthcare, education, and food. These programs are crucial for ensuring economic stability, reducing poverty, and promoting social equity. The benefits of financial assistance extend to a wide range of individuals and families, including:…

Fixed Rent vs. Variable Rent Explained: Key Factors to Consider Before Signing a Lease

Introduction to Fixed Rent and Variable Rent Definition and Basic Concepts Key Differences Between Fixed and Variable Rent Structures Feature Fixed Rent Variable Rent Payment Amount Remains constant Can fluctuate Basis for Calculation Predetermined amount Agreed-upon factors (e.g., market rates, sales performance) Risk Primarily borne by the landlord Shared between landlord and tenant Flexibility Limited…

Why You Need an Emergency Fund: The Key to Financial Stability

What Is an Emergency Fund? An emergency fund is a financial safety net designed to cover unexpected expenses that arise without warning. It’s a pool of money set aside specifically to handle unforeseen situations, such as job loss, medical emergencies, or natural disasters. The Purpose and Importance of Having an Emergency Fund The primary goal…

Why Debt Collection Matters: What Happens When You Can’t Pay?

Debt Collection Strategies and Tactics Debt collectors employ a variety of strategies and tactics to recover outstanding debts. These may include: It is important to note that while these strategies may be effective, they must be carried out in compliance with applicable laws and regulations, such as the Fair Debt Collection Practices Act (FDCPA). Ethical…

How Does Credit Card Utilization Impact Your Financial Health?

Introduction to Credit Card Utilization Ratio What Is Credit Card Utilization Ratio? Credit card utilization ratio is a metric that measures how much of your available credit you’re currently using. It’s calculated by dividing your outstanding credit card balances by your total credit limits. For example, if your credit limit is $1,000 and you have…

Homeownership vs Renting: Which Is Right for You in 2025?

Introduction to Homeownership vs. Renting Overview of Homeownership and Renting Understanding the Debate: Which Option is Best for You? The choice between homeownership and renting depends on various factors, including: Importance of Financial and Lifestyle Considerations Both financial and lifestyle factors play a crucial role in determining the best option. Historical Perspective: Homeownership and Renting…

What are Tenants Rights? Know your Right.

Introduction to Tenants’ Rights Definition and Importance of Tenants’ Rights Tenants’ rights are a fundamental set of legal protections afforded to individuals who rent property, whether it’s an apartment, house, or other dwelling. These rights ensure that tenants are treated fairly, have a safe and habitable living environment, and are protected from unlawful eviction or…

Rent-to-Income Ratio Explained: What You Need to Know Before Renting

The Rent-to-Income Ratio: A Financial Guide The rent-to-income ratio is a fundamental metric in housing finance, measuring the percentage of a person’s income allocated to rent. It serves as a crucial benchmark for both tenants and landlords. Definition: The rent-to-income ratio is calculated by dividing monthly rent by gross monthly income. For example, a $1,200 monthly rent on a $4,000…

How Move-In/Move-Out Inspections stop Rental Struggles

What Is a Move-In Inspection and Why Is It Important? Move-in/move-out inspections are a crucial step in the rental process, designed to document the condition of a rental property before and after a tenant’s occupancy. These inspections serve as a record of the property’s state, helping to prevent disputes and ensure a smooth transition between tenants. Importance for…

Lease Terms Explained: What You Need to Know to Protect Yourself

Introduction to Lease Terms Definition of Lease Term A lease term is the duration of a rental agreement between a landlord and a tenant, specifying the period during which the tenant has the right to occupy the property and the landlord is entitled to receive rent. It’s a foundational element of any lease agreement. Importance of Understanding Lease Terms…

Top Tips for Subletting Your Space Without Breaking Your Lease Agreement

Introduction to Subletting Subletting is a legal arrangement where a tenant, known as the sublessor, leases their rented space to another individual, known as the subtenant. This arrangement typically occurs with the landlord’s explicit consent, as outlined in the original lease agreement. The sublessor remains responsible for fulfilling their obligations to the landlord, while the subtenant becomes responsible for paying rent to…

Rent Control Explained: Benefits, Drawbacks, and How It Affects You

Rent Control: A Complex Housing Policy Rent control, a government-imposed limit on the maximum rent that can be charged for a rental unit, has been a contentious topic in housing policy debates for decades. This policy aims to protect tenants from excessive rent increases and to ensure affordable housing options. However, its effectiveness and unintended…

Top Tips for Maintaining a Positive Rental History with Every Lease

Rental History Explained: What It Means and Why It Matters A rental history is a comprehensive record of a tenant’s past rental experiences, including their track record of paying rent on time, adhering to lease agreements, and maintaining the rental property. It serves as a reference point for landlords to assess a prospective tenant’s reliability, potential suitability for a rental…

How Does the Fair Housing Act Protect You from Housing Discrimination?

Understanding the Essentials of the Fair Housing Act 1968 Definition and Purpose The Fair Housing Act (FHA) is a federal civil rights law enacted in 1968 to prohibit discrimination in housing based on race, color, religion, national origin, sex, disability, and familial status. Its primary objective is to ensure that everyone has equal access to housing opportunities, regardless of their protected characteristics. By prohibiting…

Evictions Explained: What Every Renter and Landlord Needs to Know

Eviction Explained: Definition and Key Insights for Tenants and Landlords An eviction is a legal process initiated by a landlord to terminate a tenant’s right to occupy a rental property. This action is typically taken in response to a tenant’s breach of the lease agreement or other statutory requirements. Key elements of an eviction definition: Understanding…

How to Use Lease Agreements to Protect Yourself as a Tenant or Landlord ?

What is a Lease Agreement? A lease agreement is a legal contract outlining the terms under which one party (the lessor) grants another (the lessee / renter ) the right to use property for a specified period. It’s essential in legal and business contexts, providing a clear framework for rights and obligations and often used for acquiring…

Why Your Credit Score Matters: Key Facts Everyone Should Know in 2025

Understanding Credit Scores: Definition and Importance A credit score is a numerical representation of a person’s creditworthiness. It’s a three-digit number that lenders use to assess the likelihood of someone repaying a loan. This score is based on a variety of factors, including payment history, amounts owed, length of credit history, types of credit, and new credit. The primary purpose of…

How to Use Your Credit Report to Improve Your Financial Health

What Exactly is a Credit Report? A credit report is a comprehensive document that provides a detailed overview of an individual’s financial history, specifically their borrowing and repayment behavior. It serves as a financial snapshot, helping lenders assess a person’s creditworthiness before extending loans or credit. Essential Elements of a Credit Report A typical credit report includes…

Renter’s Insurance Explained: Coverage, Costs, and Peace of Mind

Introduction to Renter’s Insurance Purpose and Explanation of Renter’s Insurance Renter’s insurance provides essential protection for your personal belongings and liability coverage within your rental property. It acts as a financial safeguard, ensuring peace of mind in the event of unforeseen circumstances such as theft, fire, or accidental damage. This type of insurance is a tailored insurance policy designed…

Understanding Security Deposits: A Comprehensive Guide for Renters

Want to know how to protect your wallet as a renter? 💰 Our comprehensive guide on security deposits covers everything from understanding your rights to avoiding common pitfalls. Don’t get caught in the rental trap! 🚫 #SecurityDeposit #RenterRights #LandlordTenant #MoneySavingTips #FinancialAdvice #RentalTips #Housing #ApartmentLiving #Homeowner #RealEstate #Budgeting #PersonalFinance #Tips #Tricks #Learn #Educate #Share #Viral #Trending

The Ultimate Guide to Financial Planning and Achieving Long-Term Goals

Planning Your Financial Future: A Step-by-Step Guide Navigating your financial future requires more than just saving money—it’s about creating a comprehensive plan that integrates all aspects of your financial life. This guide provides a detailed roadmap to help you achieve your long-term financial goals, with real-life examples and actionable advice tailored to each critical component…

The Ultimate Guide to Building Credit as a Renter: Steps You Can Take Today

What are credit scores ? Most of us are aware that having good credit scores is important in order to participate in today’s economic marketplace. Yet, few know what credit scores are or their importance. Especially renters, as there are about 100 million Americans who’re renting at any time. Timely payments are a key factor…

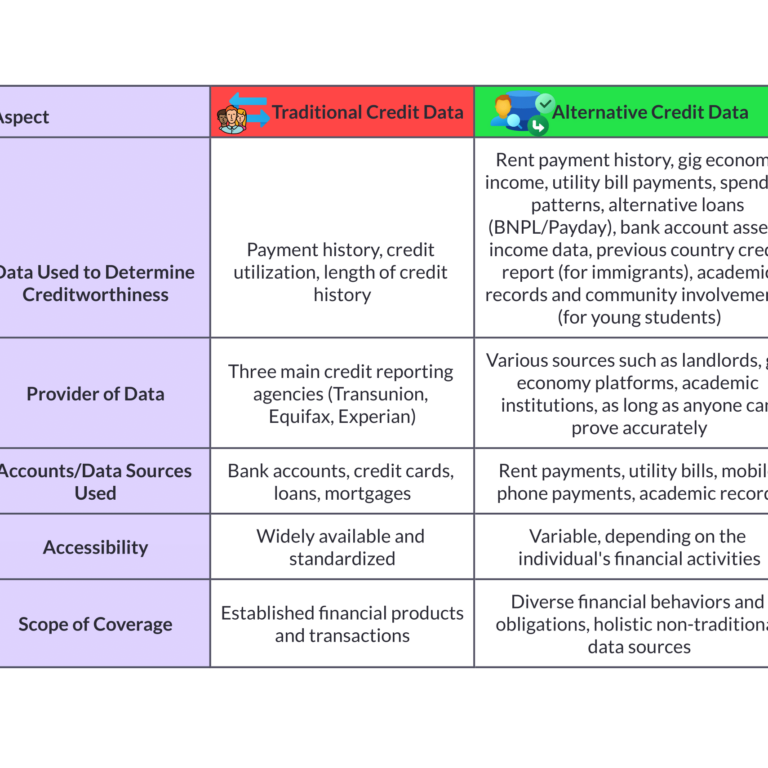

Alternative Credit Scores – Own Your Financial Future – with AxcessAltData

Ever since the mid-20th century, personal credit scores and reports have been the gold standard for lenders to evaluate the creditworthiness of individuals when applying for loans or any type of credit product. However, lenders have seen that with a high default rate, including the biggest financial crash of 2008–09 due to predatory lending, credit…

Renting Smart: Financial Tips for Renters

As a renter, managing your finances effectively is crucial for achieving financial stability. Hereare some practical tips to help you navigate the rental landscape and make informed financialdecisions: Finding Affordable Housing: Managing Utilities: Negotiating Rent Increases: Budgeting for Additional Expenses: By following these tips and adopting smart financial habits, you can navigate the rental marketeffectively…

Conquering Debt: Strategies to Pay Off What You Owe

Debt, while often a necessary part of life, can become a significant burden if not managedeffectively. It can limit your financial freedom, hinder your ability to achieve financial goals, andcause considerable stress. However, conquering debt is possible with the right strategies anddedicated effort. This guide will equip you with the knowledge and tools to tackle…

Understanding Your Credit Report: Demystifying the Numbers

Your credit report acts as a financial snapshot, detailing your credit history and influencing yourfinancial well-being.Knowing how to interpret this report empowers you to monitor your credithealth, identify potential issues, and take steps to improve your score. Understanding the Sections: Your credit report typically consists of the following sections: Interpreting the Information: ● Payment History:…

Saving for Your Future: Retirement Planning Made Simplefor Renters

Retirement might seem like a distant dream, especially for renters who prioritize immediateneeds like rent and living expenses. However, planning for your golden years is crucial,regardless of your housing situation. This guide will demystify retirement planning, introduce youto popular savings options, and offer practical tips to kickstart your journey towards a securefuture. Why Start Saving…

Building Credit: The Key to Unlocking Financial Opportunities

Credit plays a crucial role in your financial well-being, impacting everything from loan approvals to interest rates and even housing options. A good credit score acts as a gateway to numerous financial opportunities, while a poor credit history can limit your choices and lead to higher costs. This guide delves into the importance of credit,…

Budgeting 101: Your Roadmap to Financial Freedom

Living within your means and achieving financial stability starts with a simple yet powerful tool: budgeting. Budgeting is the process of creating a plan for your income and expenses, ensuring you don’t spend more than you earn. It’s your roadmap to financial freedom, empowering you to make informed financial decisions, build savings, and reach your…