Best Financial Advice: For Young Adults, Couples, Seniors & Inheritance Planning

Introduction

In today’s uncertain economy, getting the right financial advice is more important than ever. With inflation, market volatility, and changing job landscapes, managing money wisely can mean the difference between financial security and constant stress. In 2025, economic uncertainty has become the new normal. Inflation continues to reshape purchasing power, job markets remain volatile, and traditional financial advice often feels outdated in our rapidly changing digital economy.

But before we dive in, let’s get one thing straight:

“This is Not Financial Advice” – What Does It Mean Legally?

You’ve probably seen this disclaimer everywhere—from social media influencers to blog posts. Legally, it means the information provided is for educational purposes only and shouldn’t replace personalized advice from a certified financial planner (CFP) or advisor.

Why does this matter? Because everyone’s financial situation is unique. What works for one person may not work for another.

Why Financial Literacy Matters at Every Age

Whether you’re 18 or 80, understanding money is crucial. Financial literacy helps you:

- Avoid debt traps

- Build wealth over time

- Prepare for emergencies

- Make informed decisions

This guide covers financial advice for every life stage, from young adults just starting out to seniors managing retirement. Let’s get started.

Financial Advice for Young Adults

How to Build Credit Early & Avoid Debt Traps

Your credit score is like a financial report card—it impacts everything from loan approvals to apartment rentals and even some job opportunities. Here’s how to build credit responsibly:

Do This:

Avoid This:

Starting a Savings Plan & Emergency Fund

Aim for 500–500–1,000 as a starter emergency fund. Then, build up to 3–6 months of living expenses.

Where to save?

- High-yield savings accounts (HYSA)

- Money market accounts

Best Beginner Investments for Long-Term Growth

- Index funds (S&P 500)

- Roth IRA (tax-free growth)

- Robo-advisors (automated investing)

Pro Tip: Start small—even $50/month can grow significantly over time.

Understanding Your Financial Goals

Understanding your financial advice is the first step toward building a secure future. Learn how to set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) and strike the perfect balance between short-term desires and long-term aspirations. Dive into budgeting basics with the 50/30/20 rule, discover tools like Mint, Personal Capital, and YNAB to track your progress, and explore practical tips for budgeting as couples or families. Whether you’re saving for a vacation, planning for retirement, or managing household expenses, this guide equips you with the knowledge and tools to take control of your finances and achieve lasting financial success.

Setting SMART Goals

- Specific (e.g., “Save $10K for a down payment”)

- Measurable (track progress monthly)

- Achievable (realistic for your income)

- Relevant (aligns with your life stage)

- Time-bound (e.g., “in 2 years”)

Balancing Short-Term vs. Long-Term Planning

- Short-term: Vacations, gadgets

- Long-term: Retirement, buying a home

Tools to Track Goals:

Budgeting Basics

The 50/30/20 Rule

One of the most widely recommended strategies in financial advice is the 50/30/20 Rule , a straightforward budgeting method that helps individuals allocate their income effectively. This rule divides your after-tax income into three categories: needs, wants, and savings/debt repayment . By following this approach, you can achieve financial balance, prioritize essential expenses, and work toward long-term financial goals.

- 50% Needs (rent, groceries)

- 30% Wants (dining out, hobbies)

- 20% Savings/Debt Repayment

The 50/30/20 Rule is a powerful tool in the realm of financial advice , offering a practical way to manage your money responsibly while still enjoying life. By adhering to this framework, you can take control of your finances, reduce stress, and build a solid foundation for a secure financial future.

Tracking Expenses

- Use apps like Rocket Money or EveryDollar

- Review bank statements monthly

Budgeting for Couples & Families

Managing finances as a couple or family can be both rewarding and challenging. Effective budgeting not only ensures that bills are paid and savings goals are met but also fosters open communication, trust, and teamwork. When it comes to budgeting for couples and families , decisions like whether to use joint or separate accounts, how to allocate funds for childcare and education, and preparing for unexpected costs are critical to long-term financial success. In this guide, we’ll explore practical tips and strategies to help you create a budget that works for everyone involved.

- Joint vs. separate accounts? Depends on trust & spending habits.

- Family budget tip: Plan for childcare, education, and unexpected costs.

Financial Advice for Married Couples

When it comes to managing money as a married couple, one of the most important decisions you’ll face is whether to merge your finances or keep them separate. This choice can significantly impact your financial stability, communication, and overall relationship dynamics. As part of financial advice for married couples , understanding the pros and cons of joint accounts, separate accounts, and hybrid approaches can help you find a system that works best for your unique situation.

Merging Finances vs. Separate Accounts

| Pros of Joint Accounts | Pros of Separate Accounts |

|---|---|

| Transparency | Financial independence |

| Easier bill payments | Less conflict over spending |

Best approach? A hybrid model—joint for shared expenses, separate for personal spending.

Dealing with Financial Disagreements

- Schedule money talks (no surprises)

- Set shared goals (e.g., buying a home)

- Consider a financial therapist if conflicts persist

Saving Strategies: Emergency Funds & Smart Saving

Saving money is a cornerstone of sound financial advice , and having a solid savings strategy can make all the difference in achieving financial stability. Whether you’re building an emergency fund, maximizing returns on your savings, or finding ways to save on any income level, these tips will help you take control of your finances and prepare for both expected and unexpected expenses.

Building a 3–6 Month Emergency Fund

- Start with $1,000

- Gradually increase to 3–6 months of expenses

Where to Park Your Savings?

- High-yield savings accounts (Ally, Marcus)

- CDs (Certificates of Deposit) for locked-in rates

Saving on Any Income

- Low income? Automate $20/week.

- High income? Max out retirement accounts first.

Financial Advice on Inheritance

Financial Advice on Inheritance covers smart, practical steps to take when you receive an inheritance. It helps you avoid impulsive decisions, prioritize paying off high-interest debt, and guides you on how to invest wisely to grow your wealth long-term. The section also explains potential tax implications—like estate and inheritance taxes—and emphasizes the importance of creating your own estate plan through a will or living trust to protect your assets and make the process easier for your loved ones.

What to Do When You Receive an Inheritance

- Don’t rush decisions

- Pay off high-interest debt first

- Invest wisely (index funds, real estate)

Tax Implications

- Estate tax (varies by state)

- Inheritance tax (some states charge beneficiaries)

Creating Your Own Estate Plan

- Will (who gets what)

- Living trust (avoid probate)

Managing Debt Effectively

Debt management is a critical aspect of financial advice , as it directly impacts your financial health and long-term stability. Not all debt is the same, and understanding the difference between “good debt” and “bad debt” is essential for making informed decisions. With the right financial advice , you can learn how to leverage good debt to build wealth while avoiding or minimizing bad debt that can lead to financial stress. Here’s a breakdown of how to identify and manage both types of debt effectively.

Good Debt vs. Bad Debt

Not all debt is created equal. Here’s how to tell the difference:

| Good Debt | Bad Debt |

|---|---|

| Low-interest mortgages | High-interest credit cards |

| Student loans (if ROI is high) | Payday loans |

| Business loans (if profitable) | Car loans with high APR |

Key Rule: If the debt helps build wealth or increases earning potential, it might be worth it. Otherwise, pay it off ASAP.

Debt Repayment Strategies

Two popular methods:

- Debt Snowball Method : A debt repayment strategy where you pay off the smallest balances first to build momentum and stay motivated.

- Pay off smallest debts first (quick wins boost motivation).

- Example: Credit card (500)→Personalloan(500)→Personalloan(2K) → Car loan ($10K).

- Debt Avalanche Method : A debt payoff approach that targets high-interest debts first to minimize total interest paid over time.

- Pay off highest-interest debt first (saves more money long-term).

- Example: Payday loan (25% APR) → Credit card (18% APR) → Student loan (5% APR).

Which is better?

- Snowball = Psychological boost

- Avalanche = Mathmatically optimal

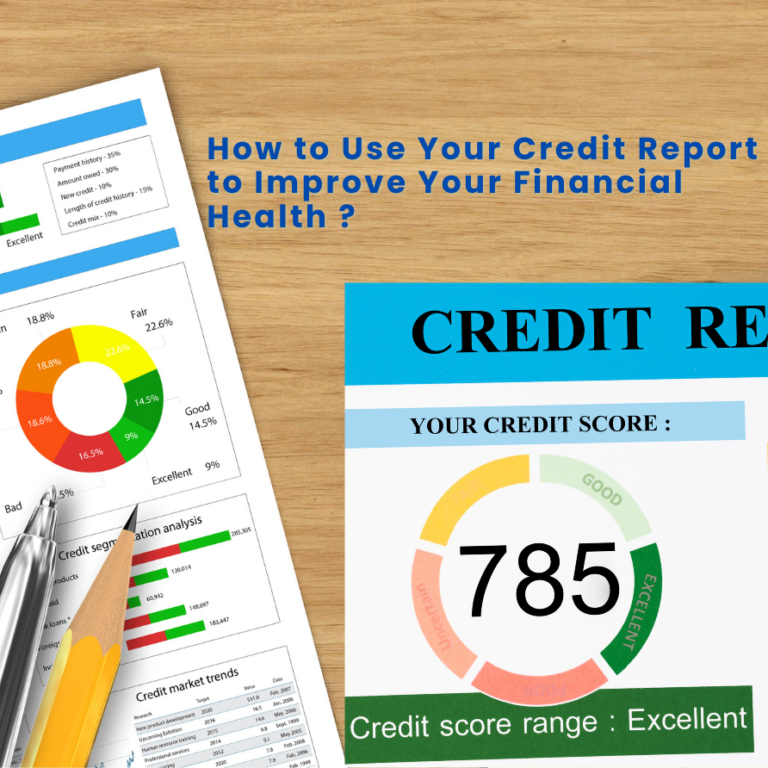

How Debt Affects Your Credit Score

- Payment history (35%) – Late payments hurt.

- Credit utilization (30%) – Keep balances below 30% of limits.

- Length of credit history (15%) – Older accounts help.

Pro Tip: Set up autopay to avoid missed payments.

Investing 101: Grow Your Wealth

Investing Terms Simplified

| Term | Definition | Best For |

|---|---|---|

| Stocks | Ownership in a company | Long-term growth |

| Bonds | Loans to governments/corporations | Stable income |

| ETFs | Bundled stocks/bonds (low fees) | Diversification |

| Index Funds | Tracks market index (e.g., S&P 500) | Hands-off investors |

Long-Term Investing vs. Day Trading

| Long-Term Investing | Day Trading |

|---|---|

| Buy & hold for years | Buy/sell within same day |

| Lower risk | High risk (90% lose money) |

| Best for most people | Requires expertise & time |

Golden Rule: Time in the market > Timing the market.

Diversification & Risk Management

- Don’t put all money in one stock (e.g., meme stocks).

- Use asset allocation (e.g., 60% stocks, 30% bonds, 10% crypto).

- Rebalance yearly to maintain risk level.

Financial Advice for Seniors

As you enter retirement, managing money wisely becomes more important than ever. Financial advice for seniors focuses on protecting savings, planning for healthcare, and making smart decisions on a fixed income. From maximizing Social Security benefits to using senior discounts and creating essential estate planning documents, these steps help ensure financial security and peace of mind in your golden years.

Managing Finances on a Fixed Income

- Downsize (sell unused property, move to a cheaper area).

- Delay Social Security (up to age 70 for max benefits).

- Use senior discounts (utilities, taxes, prescriptions).

Healthcare Planning

- Medicare vs. Medicaid – Know the difference.

- Long-term care insurance – Covers nursing homes (costs ~$100K/year).

Estate Planning Must-Dos

- Will – Dictates asset distribution.

- Living will – Medical wishes if incapacitated.

- Power of attorney – Someone to manage finances if you can’t.

Financial Advice Near Me

How to Find a Trusted Financial Advisor

Finding the right financial advisor can make a big difference in your financial journey. Start by checking their credentials—look for professionals who are Certified Financial Planners (CFP), Chartered Financial Analysts (CFA), or fiduciary advisors. These titles indicate a strong commitment to ethical, client-focused advice.

Next, understand their fee structure. A fee-only advisor charges a flat rate or percentage of assets and does not earn commissions, making their advice more objective and unbiased. In contrast, commission-based advisors may earn money by selling specific financial products, which could influence their recommendations. Always ask how they’re paid and choose the model that aligns with your comfort and financial goals.

Robo-Advisors vs. Human Advisors

| Robo-Advisors | Human Advisors |

|---|---|

| Cheap (~0.25% fee) | Expensive (~1% fee) |

| Algorithm-based | Personalized advice |

| Good for beginners | Best for complex situations |

Best Robo-Advisors (2025):

- Betterment

- Wealthfront

- Schwab Intelligent Portfolios

Financial Advice Disfinancified

Spotting Misleading Financial Advice

Social media (TikTok, YouTube) is full of:

- “Get rich quick” schemes (crypto pumps, dropshipping).

- Fake gurus selling courses with no real results.

Red Flags:

- “This one trick made me $1M!”

- No transparency (won’t show real proof).

How to Stay Grounded

- Verify sources (look for CFPs, finance journalists).

- Avoid FOMO investing (don’t buy just because others are).

Common Money Mistakes to Avoid

Financial Advice by Life Stage

Financial needs change as you move through different phases of life, and tailoring your strategy to your life stage ensures smarter, more effective money management. Young Adults should focus on building a strong financial foundation. This includes establishing credit, learning to budget, and starting to invest early to take advantage of compound growth. Even small contributions to retirement accounts like a Roth IRA can make a big difference over time. Married Couples benefit from open communication and shared planning. Whether you merge finances or keep them separate, it’s essential to create joint goals—like buying a home or saving for children—and maintain a budget that works for both partners. Transparency is key to long-term financial harmony. Seniors should prioritize protecting their savings, especially when living on a fixed income. Smart withdrawal strategies, healthcare planning, and estate planning (like setting up wills and trusts) help ensure your assets last and are passed on according to your wishes. Each life stage requires different actions—but all benefit from proactive, thoughtful financial planning.

| Life Stage | Top Priority |

|---|---|

| Young Adults | Build credit, start investing |

| Married Couples | Merge finances, plan together |

| Seniors | Protect savings, estate planning |

Conclusion

Recap of Top Financial Tips

Smart money habits start with a strong foundation. Begin early to harness the power of compound interest, budget using the proven 50/30/20 rule, and avoid costly high-interest debt. Long-term investing in index funds and ETFs builds lasting wealth, while a well-stocked emergency fund (3–6 months) protects you from life’s surprises. These timeless strategies offer financial peace of mind at any age.

- Start early (compound interest is powerful).

- Budget wisely (50/30/20 rule).

- Avoid bad debt (high-interest loans).

- Invest for the long term (index funds, ETFs).

- Plan for emergencies (3–6 months’ savings).

Take One Small Step Today

Great financial journeys begin with a single move. Open a high-yield savings account to boost your savings, start a Roth IRA for tax-free retirement growth, or speak with a trusted fiduciary advisor to personalize your plan. These small actions today can lead to a secure, stress-free financial future tomorrow.

- Open a high-yield savings account.

- Set up a Roth IRA.

- Talk to a fiduciary advisor.

Final Reminder: This guide is educational—always consult a certified professional before making big financial decisions.

FAQS

What is the best financial advice for young adults in 2025?

The best financial advice for young adults includes building credit responsibly (secured cards, on-time payments), starting an emergency fund (500−500−1,000 initially), and investing early in index funds or Roth IRAs. Avoid high-interest debt and focus on long-term growth.

How much should I have in my emergency fund?

Experts recommend saving 3-6 months’ worth of living expenses. Start with 500−500−1,000 for minor emergencies, then gradually build up. Keep it in a high-yield savings account (HYSA) earning 4-5% APY.

What’s the fastest way to build credit at 18?

The fastest ways to build credit at 18 are:

- Get a secured credit card

- Become an authorized user on a parent’s account

- Pay all bills on time

- Keep credit utilization below 30%

How much should I invest as a beginner?

Beginners can start with just $50/month in low-cost index funds (like S&P 500 ETFs) or through robo-advisors. Consistency matters more than the amount when starting out.

What’s better: paying off debt or saving money?

Follow this priority order:

- Save 500−500−1,000 emergency fund

- Pay off high-interest debt (credit cards > 7% APR)

- Build 3-6 month emergency savings

- Invest while paying off low-interest debt (mortgages, student loans < 5%)

How do I find legitimate financial advice near me?

Search for “fee-only fiduciary financial advisors near me” – they’re legally required to act in your best interest. Check FINRA’s BrokerCheck for credentials and avoid advisors who earn commissions.

What are the safest investments for beginners?

Safest beginner investments include:

- High-yield savings accounts (4-5% APY)

- S&P 500 index funds (like VOO or SPY)

- Roth IRAs (tax-free growth)

- Treasury bonds (backed by U.S. government)

How much should I spend on rent?

Follow the 30% rule: Spend no more than 30% of your gross income on rent. For example, if you earn 3,000/month,limitrentto3,000/month,limitrentto900. Consider roommates or cheaper areas if needed.

What does “this is not financial advice” mean?

This disclaimer means the information is educational, not personalized recommendations. Always consult a Certified Financial Planner (CFP) for advice tailored to your situation, especially for complex decisions like investments or taxes.

How can I avoid financial scams in 2025?

Red flags include:

- “Guaranteed” high returns with no risk

- Pressure to invest immediately

- Unregistered sellers (always check SEC’s EDGAR database)

- Requests for crypto-only payments